†Case Background

On September 2,

2025, Florida Public Utilities Company (FPUC or Company) filed a petition for

approval of its Gas Utility Access and Replacement Directive (GUARD) cost

recovery factors for January through December 2026. The petition includes the

direct testimony and Exhibit BD-1 of FPUC witness Bryan Dayton providing the

calculations of the proposed factors and Third Revised Sheet No. 7.403.

By Order No.

PSC-2023-0235-PAA-GU (GUARD Order),the

Commission approved FPUCís 10-year GUARD program consisting of two components: (1)

replacement of problematic pipes and facilities, and (2) relocation of mains and

service lines located in rear easement and other difficult to access areas to

the front lot easements. As established in the GUARD Order, FPUC is

able to recover the revenue requirements of expedited programs to replace

problematic pipes and facilities and to relocate certain facilities in rear

easements and other difficult to access areas in order to enhance the safety of

portions of FPUCís natural gas distribution system through a monthly surcharge

on customersí bills. The GUARD Order further established the methodology for

annually setting the GUARD surcharge to recover the costs of the program.

The

methodology to calculate the GUARD program surcharges is the same that was

approved for FPUCís concluded Gas Replacement and Infrastructure Program. In the GUARD Order, the Commission

directed FPUC to file its annual GUARD program petition to revise the surcharge

on or before September 1 of each year, to implement the revised surcharge

effective January 1 through December 31 of the following year.

By

Order No. PSC-2024-0504-TRF-GU, the Commission approved

FPUCís 2025 GUARD cost recovery factors and associated

Second Revised Sheet No. 7.403, which was effective from the first billing

cycle of January through the last billing cycle of December 2025.

Included

in this recommendation are Attachment A - list of GUARD projects for 2024-2026

Actual/Forecast, and Attachment B - Third Revised Tariff Sheet No. 7.403

legislative version.

During the

review process, staff issued a data request to FPUC on September 22, 2025, for

which responses were received on October 6, 2025. By Order No. PSC-2025-0392-PCO-GU,

the Commission suspended the proposed tariffs. The Commission has jurisdiction over this

matter pursuant to Sections 366.04, 366.05, and 366.06, Florida Statutes

(F.S.).

Discussion

of Issues

Issue 1:

Should the Commission approve FPUC's 2026 Gas

Utility Access and Replacement Directive (GUARD) cost recovery factors and

associated Third Revised Sheet No. 7.403 for the period January to December

2026?

Recommendation:

Yes. The Commission should approve FPUC's 2026 GUARD

cost recovery factors and associated Third Revised Sheet No. 7.403, included in

Attachment B to this recommendation, to be effective for the first billing

cycle of January 2026 through the last billing cycle of December 2026. The

Commission should also approve FPUCís request to provide six months of actual

and six months of estimated data in its actual/estimated true-up filings. The

GUARD surcharge would allow FPUC to replace problematic pipes and facilities

and relocate certain facilities located in rear easements to the front

easements, and recover the project costs on an expedited basis. (Guffey)

Staff Analysis:

The GUARD program is driven by risks identified

under FPUCís Distribution Integrity Management Program and risk assessments

performed by an independent contractor.[5]

As stated by witness Dayton and in responses to staffís data request, the GUARD

projects are based upon risk assessment categorized as high, medium, and low

risk, by an independent contractor. Projects in high consequence areas and

those of high risk continue to be a priority. The prioritized projects for 2025

and 2026 are included in Attachment A to this recommendation. Attachment A

indicates that FPUC currently has nine projects in-progress which will relocate

30.21 miles of pipes from rear lots to the street front and install 1,568

service lines in Palm Beach and Seminole counties for an estimated investment cost

of $22.6M during 2025. For 2026, 30 projects which include replacing

obsolete/Aldyl-A pipes, span pipes, under building, and relocation of pipes

from rear lot easements to the front lot easements for 53.13 miles and 2,203

service lines in Palm Beach, Polk, Seminole, and Volusia counties are listed

for an estimated investment cost of $25.14M.

The Company requested that the

actual/estimated true up amounts be based on six months of actual data and six

months of projected data. In the past filings, the Company provided seven

months of actual data and five months of projected data. The Company included

this revision in this filing and intends to apply it to all future GUARD filings.

The Company explained that this change would better align FPUCís GUARD filing

with its sister company, Florida City Gasí Safety, Access, and Facility

Enhancement (SAFE) program filing, because the annual SAFE filing also utilizes

six months of actual data and six months of estimated data. Furthermore, any

difference between actual and estimated data would be incorporated in the next

yearís true up.

FPUCís True-Ups by Year

FPUCís calculation for the 2026 GUARD revenue requirement

includes a final true-up for 2024, actual/estimated true-up for 2025, and

projected costs for 2026.

Final 2024 GUARD True-Up

Company witness Dayton states that the January through

December 2024 true-up resulted in an under-recovery of $701,550, inclusive of

interest. As shown in Schedule C-1 of the petition, the 2023 ending balance was

an over-recovery of $571,835. Combined with the 2024 under-recovery of $1,283,709,

and year-end monthly interest expense of $10,324 associated with any over- and

under-recoveries results in a final 2024 under-recovery of $701,550.

Actual/Estimated 2025 GUARD True-Up

The January through December 2024 GUARD investment and

associated revenue requirement amounts are shown on Exhibit BD-1, page 2 of 7.

In 2024, the actual beginning balance was an under-recovery of $701,550 (inclusive

of interest). As shown on Exhibit BD-1, page 3 of 7, the 2025 actual (January

through June) and forecasted (July through December) GUARD true-up is an over-recovery

of $658,951 (inclusive of interest), resulting in an overall under-recovery of

$42,599. As shown in Table 1-1 below, this under-recovery is being applied to

the 2026 GUARD revenue requirement, resulting in a higher revenue requirement

to be recovered from customers in 2026.

Projected 2026 GUARD Revenue Requirement

For 2026, FPUC plans to invest $24,902,464 ($18,023,786

for mains, $5,998,678 for service lines, and $880,000 for meters), resulting in

a total qualified investment of $110,515,998 (including the year-end 2025

investment) in 2026. The GUARD program revenue requirement includes a return on

investment, depreciation expense, extending customer-owned fuel lines (to

connect to meters which require to be relocated due to safety issues), customer

notification expense, and property taxes. All expenses are dependent upon the

level of investment costs. After adding the 2025 under-recovery true-up amount

of $42,599, the 2026 GUARD revenue requirement to be recovered through the

proposed surcharges is $10,180,614.

Table 1-1

2026 GUARD Revenue

Requirement Calculation

|

2026 Total Qualified

Investment

|

$110,515,998

|

|

2026 Return on Investment

|

$6,842,806

|

|

Depreciation Expenses

|

$1,615,761

|

|

Fuel Line Expenses

|

$24,000

|

|

Property/Ad Valorem Tax Expense

|

$1,635,408

|

|

Customer Notification Expense

|

$20,040

|

|

2026 Net GUARD Revenue Requirement

|

$10,138,015

|

|

Plus 2025 Under-Recovery

|

$42,599

|

|

2026 Total Revenue Requirement

|

$10,180,614

|

Source: Witness Daytonís Testimony Exhibit BD-1, Schedule

C-2, Page 4 of 7.

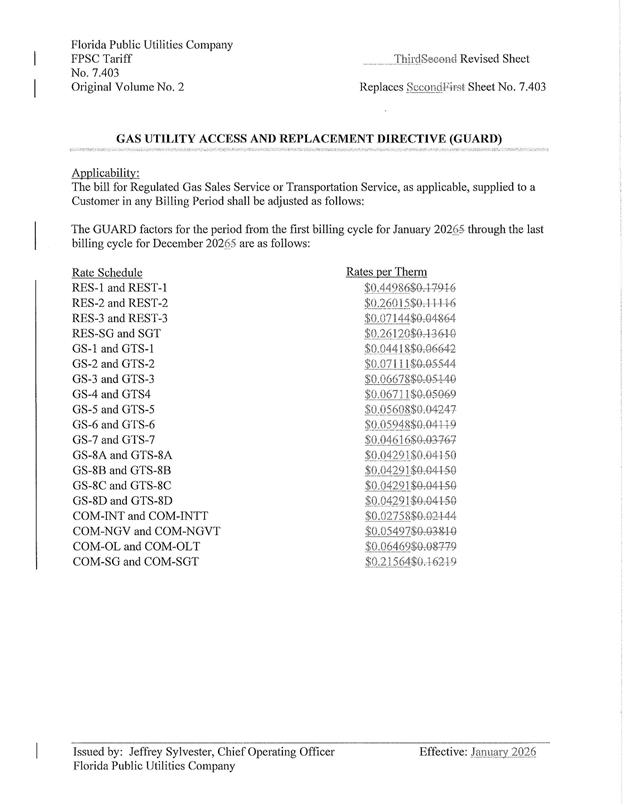

Proposed 2026 GUARD Surcharges

As approved in the 2023 GUARD Order, the total 2026

revenue requirement is allocated to the rate classes using the same methodology

used for the allocation of mains and service lines in the cost of service study

used in the Companyís most recent rate case. The respective percentages were

multiplied by the 2026 revenue requirement and divided by each rate classís

projected therm sales to provide the GUARD surcharge for each rate class. This

methodology was originally established by the 2012 Order approving FPUCís GRIP

program.

In 2025, the monthly bill impact was $2.22 for a residential

customer using 20 therms per month or $26.64 per year. The proposed 2026 GUARD

surcharge for FPUCís residential customers who use 20 therms a month on the

Residential Service tariff (RES-2) would pay $0.26015 per therm compared to the

2025 GUARD surcharge of $0.11116 per therm. The monthly bill impact for 2026

would be $5.20 for a residential customer using 20 therms per month or $62.44

per year. The proposed GUARD surcharges are shown in Attachment B, in Third

Revised Sheet No. 7.403.

Conclusion

The Commission should approve FPUC's 2026 GUARD cost

recovery factors and associated Third Revised Sheet No. 7.403, included in

Attachment B to this recommendation, to be effective for the first billing

cycle of January 2026 through the last billing cycle of December 2026. The

Commission should also approve FPUCís request to provide six months of actual

and six months of estimated data in its actual/estimated true-up filings. The

GUARD surcharge would allow FPUC to replace problematic pipes and facilities

and relocate certain facilities located in rear easements to the front

easements, and recover the project costs on an expedited basis.

Issue 2:

Should this docket be closed?

Recommendation:

Yes.† If a

protest is filed within 21 days of the issuance of the order, the tariffs

should remain in effect, with any revenues held subject to refund, pending

resolution of the protest.† If no timely

protest is filed, this docket should be closed upon the issuance of a

consummating order. (Dose)

Staff Analysis:

If a protest is filed within 21 days of the issuance

of the order, the tariffs should remain in effect, with any revenues held

subject to refund, pending resolution of the protest.† If no timely protest is filed, this docket

should be closed upon the issuance of a consummating order.